Basic Policy

At Nippon Shinyaku, we recognize that it is a critical management priority to fulfill our accountability to all stakeholders, by securing the transparency of management in order to raise our corporate value through social contributions. This makes it essential for our corporate governance to function effectively, and we are committed to further expanding the framework for internal control, compliance, and risk management.

The Company shall,

- (1) Respect the rights of shareholders and ensure the equality

- (2) Have a responsibility to all stakeholders including shareholders and cooperate the stakeholders appropriately.

- (3) Disclose Company information timely and properly, and ensure transparency and equality of decision-making.

- (4) Make effective use of management resources and augment management activities by prompt and resolute decision-making.

Additionally, on December 15, 2015, the Company laid down the Corporate Governance Basic Policy, which defines its basic principles and policies on corporate governance. The Policy was revised on June 27, 2024.

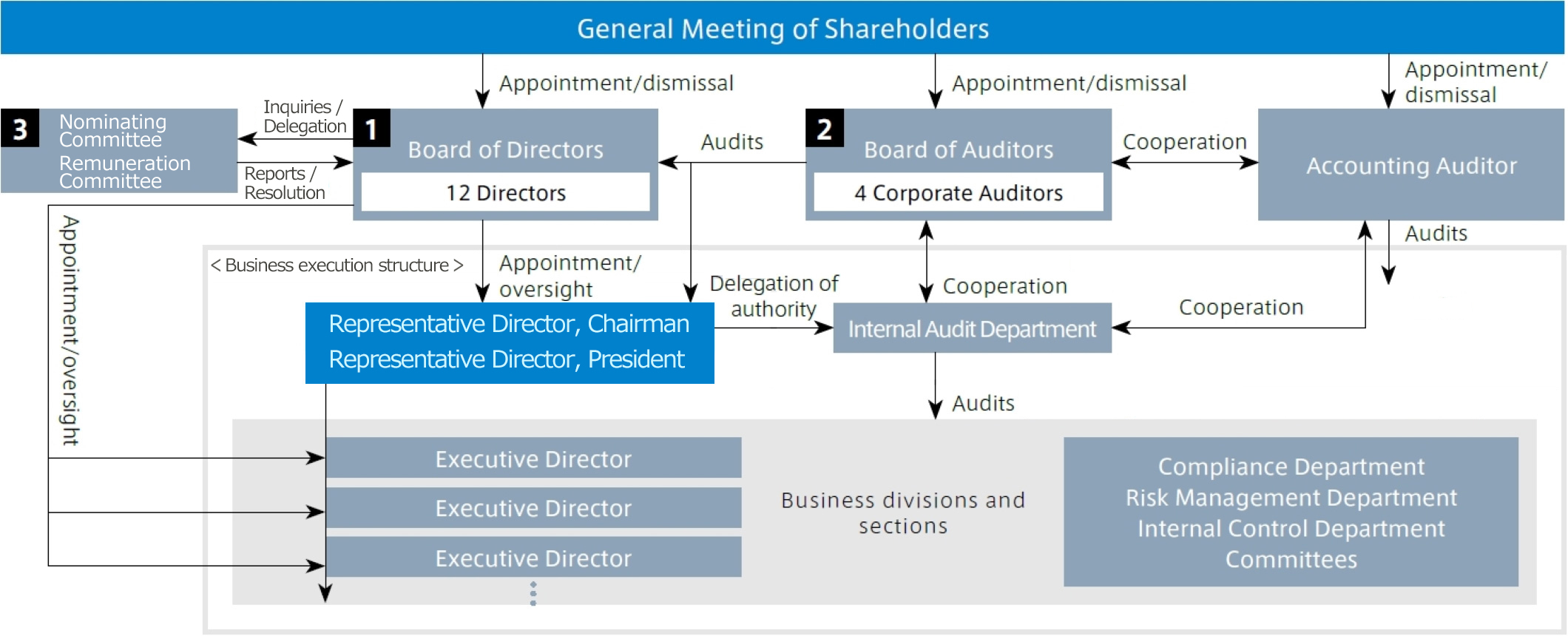

Overview of Framework for Corporate Governance

The Company is a Company with Auditors which consists of 12 Directors including 4 external directors and 4 Auditor & Supervisory Board Members (Corporate Auditors) including 2 outside auditors.

To clarify the management responsibility and establish the optimal management system against changes of management circumstances agilely, the Company requires the Directors to serve one-year term.

The Company appoints 4 external Directors to further strengthen oversight of company operations by the Directors and strive to further progress the management transparency and objectivity. The Company adopted an auditor system in which Auditor & Supervisory Board Members shall attend all Board meetings and critical meetings on business. The Company ensures the independence of 2 outside auditors from the Company and the management oversight function by Audit & Supervisory Board.

| Board of Directors | Audit & Supervisory Board | Nominating Committee and Remuneration Committee | |

|---|---|---|---|

| Attendees |

|

|

|

| Role |

|

|

|

| Meetings held in FY2024 |

15 (13 regular meetings, 2 extraordinary meetings) |

24 | 4 (Nominating Committee: 1; Remuneration Committee: 3) |

Related materials

- Corporate Governance Basic Policy(Last Update:June 27, 2024) PDF314 KB

- Corporate Governance Report(Last Update:June 30, 2025) PDF673 KB

Management Team(Career / Reasons for Appointment / Attendance at board meetings)

Criteria for Judgment of Independence

Outside executives (External Directors and External Auditors) and other candidates that do not come under any of the following categories shall be considered by the Company to have an adequate degree of independence.

- (1) Current or past executives of the Company (including subsidiaries; likewise hereafter)

- (2) Major transaction partners of the Company, or their executives

- (3) Parties for which the Company is a major transaction partner, or their executives

- (4) Consultants, accountancy specialists or legal experts (in the case of corporations, associations and other groups, those who belong to such groups) who receive large sums of money or other assets from the Company in forms other than executive remuneration

- (5) Major shareholders of the Company or their executives

- (6) Parties who receive significant monetary donations from the Company (in the case of corporations, associations and other groups, executives of such groups)

- (7) Any close relative(s) of those specified in (1) to (6) who is a significant party

- * Notes

- (1) - (6) “Executives” above refers to Executive Directors, Corporate Officers or any other individuals or employees with equivalent status

- (2) “Major transaction partners of the Company” refers to any transaction partner who has accounted for more than 2% of consolidated sales of the Company by transaction amount over the most recent business year

- (3) “Parties for which the Company is a major transaction partner” refers to any transaction partner for which the Company is deemed important; that is, the Company has accounted for more than 2% of consolidated sales of such partner by transaction amount over the most recent business year

- (4) and (6) “Large sums” refers to sums in excess of ¥10 million or exceeding 2% of consolidated sales or total revenues of the party in question

- (5) “Major shareholders of the Company” means shareholders holding at least 10% of the total voting rights

- (7) “Significant party” means executives of general manager grade or higher, and “close relative(s)” refers to spouse or family members in second degree

Evaluation of effectiveness of the Board of Directors

Results of fiscal 2024 evaluation

Once each year, Nippon Shinyaku evaluates the Board of Directors at a Board of Directors meeting in an effort to bring about improvements that will enhance its effectiveness. In order to analyze and evaluate the overall effectiveness of the Board of Directors, in FY2024 the Company implemented a self-evaluation survey for all Directors. As a result, it was able to confirm that within the Board of Directors, each executive Director and Outside Director continued to actively make remarks, that open-minded and constructive discussions were pursued from a wide perspective, and that appropriate judgment was being performed by the management, and therefore determined that the overall effectiveness of the Board of Directors was properly maintained.

Response to the Corporate Governance Code

Conforming to the objectives and spirit of the Corporate Governance Code established by the Tokyo Stock Exchange (TSE) in June 2015, Nippon Shinyaku reexamined the status of its activities with regard to the General Principles of the Corporate Governance Code so as to ensure sustainable growth and medium- to long-term enhancement of its corporate value. Nippon Shinyaku implemented “Disclosure Based on the Principles of the Corporate Governance Code” in its Corporate Governance Report.

Officers’ Remuneration

Total sum of remuneration for each officer category, subtotals of types of remuneration, and the number of recipient officers (FY 2024)

| Officer category | Total sum (millions of yen) |

Subtotal by type (millions of yen) | Number of recipient officers | ||

|---|---|---|---|---|---|

| Basic fixed remuneration | Performance-linked remuneration | Restricted Stock Compensation | |||

| Directors (excluding external directors) |

441 | 214 | 136 | 90 | 8 |

| Auditors (excluding external auditors) |

34 | 34 | - | - | 3 |

| External directors & external auditors |

60 | 60 | - | - | 7 |

Officers’ remuneration, the sum and calculation method, and how they are determined

In Nippon Shinyaku’s policy on officers’ remuneration, the sum and calculation method are determined on the basis of each officer’s grade and performance. The monthly salary is composed of a fixed part based on the grade and a part based on performance appraisal. Bonuses (offered to executive directors only) are performance-linked and set by multiplying the company’s annual operating income by a fixed percentage attributed to each officer grade.

Dialogue with Shareholders

To ensure sustainable growth and enhance medium- to long-term corporate value, Nippon Shinyaku actively engages in constructive dialogue with its shareholders. Such dialogue is followed up with the company’s efforts to develop and improve internal systems for reliable information disclosure and mechanisms that incorporate learnings from dialogue with shareholders into company management.

In addition, President Nakai has been attending financial results briefings, shareholder and investor meetings, overseas IR events and large meetings, and will continue to regularly interact with shareholders and investors to explain the Company’s growth strategies in the short, medium, and long term.

Cross-shareholdings and the basic policy on the exercise of voting rights related to cross-shareholdings

- Nippon Shinyaku decides for or against cross-shareholdings in view of the importance of forming or maintaining transactions with concerned parties, the reinforcement of business partnership and other operating alliances, and the rationality of cross-shareholdings in terms of risks and returns.

- With regard to major cross-held shares, Nippon Shinyaku’s Board of Directors periodically checks the rationality of their purposes and economic efficiency at its meetings.

- Nippon Shinyaku responsibly exercises its voting rights associated with cross-held shares by examining whether or not the motions in question contribute to the enhancement of Nippon Shinyaku’s and the issuing company’s corporate value.

Succession Plan

Succession Plan

Nippon Shinyaku recognizes that it is important to train successors from various perspectives based on the future vision of the Company. We run HONKI Juku selective training programs which are classified into Leader, Management, and Executive according to the position and number of years at the Company of trainees.

The Leader program targets the younger group aged 25-35 to quickly uncover and pick out leadership candidates. The Management program provides lectures on management basics and middle management for executives aged 36-45 to acquire the perspective of a department manager. The Executive program aims for acquisition of practical management knowledge to train the next generation of management candidates. In FY2024, 23 people participated in the three levels of the HONKI Juku (the second class). The goal is to have 115 people take classes over a five-year period. These efforts enable us to constantly secure motivated and outstanding human resources as we strive to develop and acquire the human resources that will lead the Company in the future.

Training for Officers

Nippon Shinyaku holds training and debriefing sessions attended by all Directors, in order to convey information that is essential for Directors on legal responsibilities, corporate governance, etc., and to share information on the important operations performed by each division. Audit & Supervisory Board Members can also attend these sessions. New Directors and new Audit & Supervisory Board Members receive new officer training offered internally upon their assumption of office. In this manner, Nippon Shinyaku provides the necessary training opportunities for Directors and Audit & Supervisory Board Members, covering any expenses incurred.

Basic Policy on Internal Control System

The Company is striving to act with higher ethical sense, putting human dignity first and taking consistently into consideration of social contribution. The Company recognizes the aforementioned is involved closely to the progress of corporate value. Internal control system is a measure to achieve it and shall be practiced by all the people who comprise a business organizer. The reliability of financial reporting shall be ensured based on compliance with law and enhancement of effectiveness and efficacy in business. The Company thinks that internal control system shall provide the rational assurance, aiming at its goal to ensure the above reliability.

Skills Matrix

Shigenobu Maekawa

Toru Nakai

Takashi Takaya

Takanori Edamitsu

Hitoshi Ishizawa

Hitomi Kimura

Kazuyuki Iwata

Keiichi Kuwano

Yoshinao Wada

Yukari Kobayashi

Mayumi Nishi

Yohtaro Hongo

Hirotsugu Ito

Eriko Doi

Hiroharu Hara

Mariko Chaki

| Category | Name | Skills and experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Category | Name | Skills and experience | |||||||||

| Corporate management/ Management strategy |

Global business |

Finance/ Accounting |

Legal affairs/ Risk management |

Research & Development |

Sales/ Marketing |

Production/ Quality |

Personnel/ HR development |

ESG/ Social contribution |

IT/ Information management |

||

| Director (Inside) |

Shigenobu Maekawa |

● | ● | ● | ● | ● | ● | ||||

| Toru Nakai | ● | ● | ● | ● | |||||||

| Takashi Takaya |

● | ● | ● | ● | ● | ● | |||||

| Takanori Edamitsu |

● | ● | ● | ● | |||||||

| Hitoshi Ishizawa |

● | ||||||||||

| Hitomi Kimura |

● | ● | ● | ||||||||

| Kazuyuki Iwata |

● | ● | |||||||||

| Keiichi Kuwano |

● | ||||||||||

| Director (Outside) |

Yoshinao Wada |

● | ● | ||||||||

| Yukari Kobayashi |

● | ● | ● | ● | ● | ● | |||||

| Mayumi Nishi |

● | ||||||||||

| Yohtaro Hongo |

● | ● | |||||||||

| Corporate Auditor (Inside) |

Hirotsugu Ito |

● | |||||||||

| Eriko Doi |

● | ● | |||||||||

| Corporate Auditor (External) |

Hiroharu Hara |

● | |||||||||

| Mariko Chaki |

● | ||||||||||

- (Note) The above list does not represent all of the expertise and experience Directors and Corporate Auditors have.

ESG Management

- Sustainability

- Corporate Governance

Inside Directors

Inside Directors Outside Directors

Outside Directors Standing Audit & Supervisory Board Members

Standing Audit & Supervisory Board Members Outside Audit & Supervisory Board Members

Outside Audit & Supervisory Board Members Chairperson

Chairperson