In December 2021, Nippon Shinyaku declared its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).*1 In addition to working to address already identified risks from the perspective of risk management, the Company will enhance its information disclosure by collecting and analyzing data for scenario analysis of climate-related risks and opportunities in the framework of the TCFD recommendations and devising specific measures to address identified risks and opportunities.

- *1 The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015 by the Financial Stability Board (FSB) to develop recommendations for more effective climate-related disclosures to be made by companies to investors, lenders and insurance underwriters.

Governance

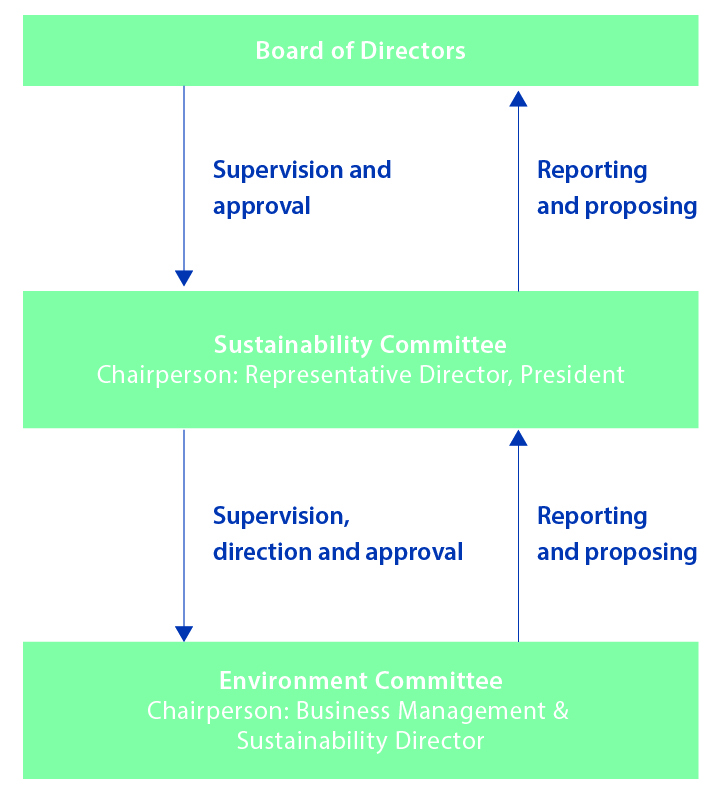

In our efforts to be more proactive in promoting sustainability, the Nippon Shinyaku Group’s Sustainability Committee, which meets twice a year and is chaired by our President, is discussing, reviewing, and making decisions regarding the key issues concerning sustainability for the entire Group. The Committee assesses and supervises climate change countermeasures, which have been identified as a material issues. The Sustainability Committee also meets twice a year to review the details and progress of our sustainability-promotion activities. The Environment Committee, which meets quarterly and is chaired by the Director who serves as the Head of Business Management and Sustainability, is responsible for dealing with climate-related issues. This Committee, which is charged with executing the Group’s Basic Environment Policy as determined by the Board of Directors, formulates environmental preservation policies, promotes environmental preservation and other initiatives, and checks on the progress of environmental preservation activities, including our annual reduction in CO2 emissions. Also, the results of the Environment Committee and Sustainability Committee’s investigations are reported at least once a year to the Board of Directors, which reviews them and provides oversight.

| Name | Sustainability Committee | Environment Committee |

| Duties |

|

|

| Organizational structure |

|

|

| Frequency of Meetings | Twice a year | Four times a year |

Strategy

Scenario Analysis

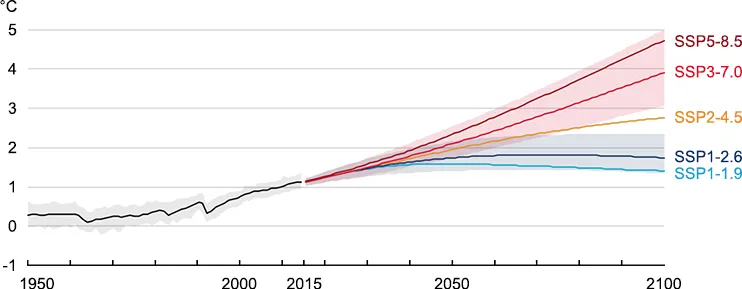

In recognition of the enormous impact that climate-related risks and opportunities will exert on the Company’s business strategies, the Nippon Shinyaku Group has identified the risks and opportunities associated with climate change and evaluated their importance. The analysis and evaluation of climate change-related risks and opportunities was conducted utilizing a 1.5°C warming scenario and a 4°C warming scenario. First, we comprehensively extracted the risks and opportunities associated with climate change, then we sorted the extracted risks and opportunities by their correlation with two of our businesses, pharmaceuticals and functional foods. Finally, we assessed their importance based on the two criteria of degree of impact on the Company and probability of occurrence.

1.5°C warming scenario

In addition to the expectation that costs will increase due to tightening of regulations, including the introduction of carbon taxes; the risk of the price of raw materials and other items increasing is also anticipated. Nippon Shinyaku is propelling initiatives to reduce carbon and has set a CO2 emissions target of 6,088 t-CO2 by FY2030 (a 42% reduction from benchmark FY2020).

4°C warming scenario

The analysis results showed that the Odawara Central Factory would not be financially impacted by a weather-related disaster and subsequent shutdown of operations, because the Factory holds approximately 4.6 months’ worth of inventory. In order to stably secure raw materials, Nippon Shinyaku is working to diversify its procurement sources and strengthen its stockpiling functions, thereby minimizing risks throughout the supply chain. In addition, the Company is promoting BCP measures, including preparation for weather-related disasters, and investment related to disaster prevention.

Selection of climate scenarios

For the 1.5°C warming scenario, SSP1-1.9 was used; for the 4°C warming scenario, SSP5-8.5 was used.

| Scenario | Reference scenario | Description |

| 1.5°C scenario | SSP1-1.9 IEA NZE2050 | Holds warming to approximately 1.5°C above 1850-1900 in 2100 after slight overshoot and implied net-zero CO2 emissions around the middle of this century. |

| 4°C scenario | SSP5-8.5 | A high-level reference scenario with no additional climate policy. Emissions as high as SSP5-8.5 are only achieved within the fossil fueled SSP5 socioeconomic development pathway. |

| Short-term,2021-2040 | Mid-term,2041-2060 | Long-term,2081-2100 | ||||

|---|---|---|---|---|---|---|

| Scenario | Best estimate(℃) |

Very high possibility range(℃) |

Best estimate(℃) |

Very high possibility range(℃) |

Best estimate(℃) |

Very high possibility range(℃) |

| SSP1-1.9 | 1.5 | 1.2~1.7 | 1.6 | 1.2~2.0 | 1.4 | 1.0~1.8 |

| SSP1-2.6 | 1.5 | 1.2~1.8 | 1.7 | 1.3~2.2 | 1.8 | 1.3~2.4 |

| SSP2-4.5 | 1.5 | 1.2~1.8 | 2.0 | 1.6~2.5 | 2.7 | 2.1~3.5 |

| SSP3-7.0 | 1.5 | 1.2~1.8 | 2.1 | 1.2~2.8 | 3.6 | 2.8~4.6 |

| SSP5-8.5 | 1.6 | 1.2~1.9 | 2.4 | 1.3~1.9 | 4.4 | 3.3~5.7 |

Identified Risk/Opportunities and Measures

| Category | Impact on Nippon Shinyaku | Details of measures of potential risks and opportunities | Indicator | Financial impact | Period | ||||

|---|---|---|---|---|---|---|---|---|---|

| Short-term | Mid-term | Long-term | |||||||

| -2025 | 2026-2030 | 2031- | |||||||

| Risks | Transition risks | Policies and laws | Risk of energy costs and procured goods prices increasing due to carbon taxes and strengthened energy conservation laws |

Estimated from the Company’s 2022 Scopes 1 + 2 targets assuming $140/t-CO₂ of carbon taxes in 2030. |

Increase in expenses | Small | ● | ||

| Delay in response to global environmental regulations |

|

● | |||||||

| Markets |

Increases in market prices of procured goods due to increases in

demand for raw materials (pharmaceuticals) Risk of decreases in demand due to increases in product prices in accordance with increased market prices of procured goods (functional foods) |

|

Decrease in expenses | Small | ● | ||||

| Stoppage of plant operation and business activities due to depletion of raw materials and other resources |

|

● | |||||||

| Evaluation | Negative impact on stock prices and fundraising due to delay in tackling climate change |

|

● | ||||||

| Physical risks | Acute risks | Increased risk of disruptions to supply chain, including raw material procurement and product shipping logistics, due to increases in regional torrential rains and largescale typhoons |

|

Decrease in expenses | Medium | ● | |||

|

|

Decrease in expenses | Small | ● | |||||

| Chronic risks | Risk of need to move plants and other sites due to impact of rising sea levels |

|

● | ||||||

| Depletion of water resources and water intake limits due to changes in rainfall patterns (reduction in profits due to reduced production capacity) |

|

● | |||||||

| Insufficient raw material procurement due to climate change |

|

● | |||||||

| Opportunities | Markets | If climate change progresses, food preservation and quality maintenance will increase in importance, and we would expect that demand for our quality and stability preservatives would increase |

|

Increase in sales | Small | ● | |||

|

Resource efficiency/ energy |

Reduction in production costs through a variety of improvements to resource efficiency, including energy conservation, reduced water utilization, and waste disposal |

|

Decrease in expenses | Small | ● | ||||

| Optimization of production and logistics processes |

|

● | |||||||

| Maintenance of cost competitiveness through introduction of renewable energies to reduce carbon tax burden |

|

● | |||||||

| Resilience | Minimizing the damage of physical risks through implementation of systematic measures |

|

● | ||||||

| Contribution to increasing corporate value through the company’s climate initiatives, including gaining customer trust, retaining employees, improving evaluation in recruitment, and improving evaluation from ESG investors |

|

● | |||||||

| Large | Impact on the relevant segments’ operating profit is 30% or more |

| Medium | Impact on the relevant segments’ operating profit is at least 15% but less than 30% |

| Small | Impact on the relevant segments’ operating profit is less than 15% |

Nippon Shinyaku is continually working to improve its environmental conservation activities (conserving energy and reducing CO2 emissions) based on its Basic Environmental Policy in order to achieve carbon neutrality by 2050.

The Company is promoting decarbonization efforts such as switching to renewable energy-derived electricity by installing solar power generation systems and switching sales vehicles to hybrid models. In addition, when renewing factory and research equipment, contribution to greenhouse gas emissions reduction is employed as one of the evaluation criteria.

We recognize that addressing Scope 3 emissions, which encompass the entire supply chain, is a critical task, and we will continue to work in close collaboration with our suppliers to promote decarbonization efforts.

Seeing the transition to a low-carbon economy as an opportunity, the Nippon Shinyaku Group will strive to further strengthen its competitiveness by reducing fossil fuel-derived energy costs and promoting innovation in the functional food field.

Risk Management

The Nippon Shinyaku Group has in place Basic Risk Management Rules, with the Director who is the Head of Personnel, General Affairs, Risk Management, Compliance & Digital Transformation acting as the Risk Management Officer, and a department dedicated to overseeing risk management. We have identified various possible risks, including climate change-related ones. Each department has devised measures to prevent the actualization of those risks and to respond to any realized risk. Further, every year, action plans are formulated to address the risks selected as highly serious for the entire Group or each department and enhance measures to prevent their actualization. The results of these activities are reported to the Risk & Compliance Committee and then to the Board of Directors at the end of each fiscal year so that activities in subsequent years will be improved.

| FY2025 activity themes | Risk management goals |

|---|---|

| Natural disasters (earthquakes, eruptions, tsunamis, typhoons, wind disasters, lightning strikes, etc.), fires, and explosions |

|

| Enhancement of various disaster drills at the Odawara Central Factory |

|

| Risk of pharmaceutical product supply disruption | Produce and release our first-ever frozen liquid formulation as scheduled. |

| Stable procurement of functional food raw materials, products, etc. | For all functional food items we handle, monitor the supply-demand balance and implement appropriate inventory management. |

| Appropriate management of chemical substances | Promote appropriate management of chemical substances by reducing the amount of chemical substances possessed, properly operating the chemical substance management system, and responding promptly and appropriately to revisions to applicable laws. |

Indicators and Targets

Nippon Shinyaku has established a greenhouse gas reduction target of reducing its greenhouse gas (Scope 1 and 2) in FY2030 42% from benchmark FY2020. As a climate-related opportunity the company has also established the ratio of hybrid company-owned vehilcle activities as a key performance indicator. Further, we will be striving to assess our capital outlays and allocation by using as indicators investments in environmentallyconscious facilities and facilities which contribute to reduced greenhouse gas emissions.

| Greenhouse gas emissions | 42% reduction in greenhouse gas emissions in FY2030 (over FY2020) |

| Climate-related opportunity | Increase ratio of hybrid company-owned vehilcle activities |

As part of efforts to reduce CO2 emissions, we have formulated a roadmap toward achieving carbon neutrality. In 2021, we began switching to electricity derived from renewable energy sources, including installation of solar power generation facilities.We have also promoted the introduction of hybrid vehicles for our sales fleet. We set the hybrid vehicle ratio as a KPI and replaced all sales vehicles with hybrid models over a four-year period starting in FY2020, except for those used in regions with heavy snowfall.

Through these initiatives, the Nippon Shinyaku Group reduced its total CO2 emissions (Scope 1 and Scope 2) by more than 20% byFY2024.

We will continue to expand the switch to renewable energy-derived electricity. In addition, to reduce CO2 emissions in our supply chain, we will work to enhance engagement with our suppliers. Through various initiatives, we will continue striving to achieve our CO2 emission reduction targets.