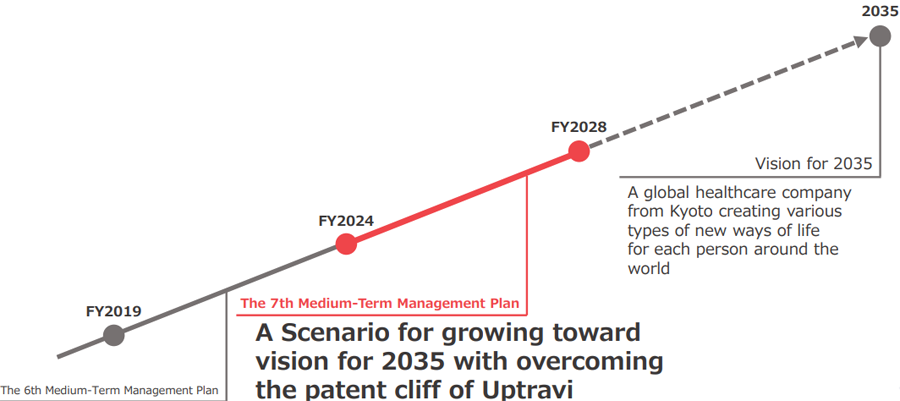

7th Five-Year Medium-Term Management Plan~For Global Growth Beyond the Cliff~

Vision for 2035

A global healthcare company from Kyoto creating various types of new ways of life for each person around the world

In this time when there are various ways of thinking and life, all of our employees think about one’s life together and we will provide values to the world without being bound by existing products and frameworks.

By doing this, we aim to contribute to the life of people around the world.

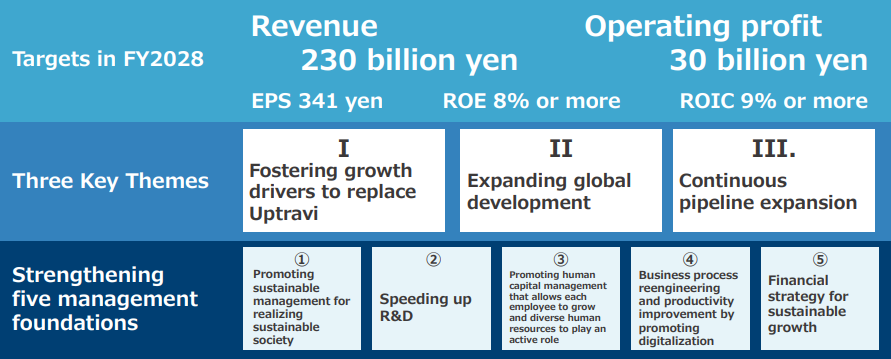

Overview of the 7th Five-Year Medium-Term Management Plan

The 7th Five-Year Medium-Term Management Plan was formulated based on a scenario of generating growth by overcoming the loss of the Uptravi patent, and further strengthening our foundation for providing products and services globally with thinking about the life of each patient and customer as we strive to realize our “Vision for 2035.”

During the 7th Medium-Term Management Plan, we will promote "three key themes and strengthening five management foundations". In each of the Pharmaceuticals and Functional Food segments, we will thoroughly allocate management resources and reduce costs by prioritizing them based on business strategies, and manage the capital efficiency of each segments by ROIC to secure earnings that exceed the cost of capital.

Three Key Themes

- Ⅰ.Fostering growth drivers to replace Uptravi

- We will launch on average two or more items annually as growth drivers during the 7th Medium-Term Management Plan and achieve early market penetration.

These items include ones from the DMD products globally (CAP-1002, NS-089/ NCNP-02, NS-050/NCNP-03, and NS-051/NCNP-04), new hematologic cancer products in Japan (Vyxeos, Jaypirca, and NS-401), and product life cycle management (PLCM) products (Gazyva for renal disease, Fintepla, and Uptravi for ediatric and high-dose formulations). - II. Expanding global development

- In addition to the already-launched Viltepso, the U.S. subsidiary NS Pharma plans to launch several DMD treatments, including the cell-therapy CAP-1002. With an eye toward quickly launching these products, the Company is focusing on expanding effective, efficient marketing and services that support patients.

In addition to preparing to launch Viltepso through the two Chinese subsidiaries Beijing Nippon Shinyaku Co., Ltd., and Tianjin Nippon Shinyaku Co., Ltd., we are moving forward with building a functional food marketing system.

In order to provide patients around the world, not only the U.S. and China, with our products, we are accelerating our global expansion by examining various methods, including in-house sales, alliances, and M&As. - III. Continuous pipeline expansion

- We will continue to expand our pipeline, primarily through in-house drug discovery, in-licensing, and PLCM.

As for in-house drug discovery, we are working to strengthen this by combining our strengths with new and outside technology. Leveraging open innovation and AI drug discovery, we are moving forward with nucleic acid drug discovery (DMD and central nervous system) and small molecule drug discovery (hematology, intractable/rare diseases, urology and gynecology diseases).

For in-licensing, priority is given to items that will lead to global sales, and our goal is to acquire more than one in-licensed item in post-clinical trial phase every year.

Turning to PLCM, we will begin working on clinical trials for a second indication quicker than previously to maximize the value of the drug.

Strengthening Five Management Foundations

-

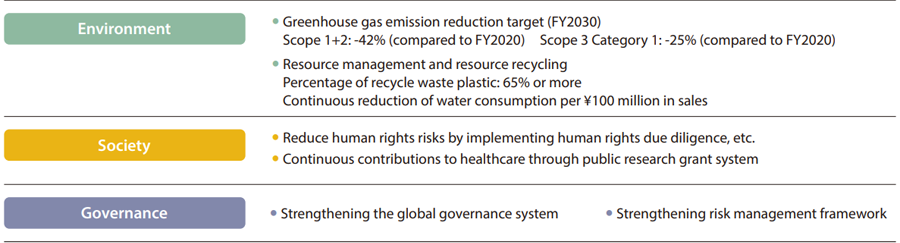

- (1) Promoting sustainability management for realizing sustainable society

-

It will be impossible for us to survive unless we realize a sustainable society. While promoting sustainability management to realize a sustainable society, we actively work to solve five material issues.

-

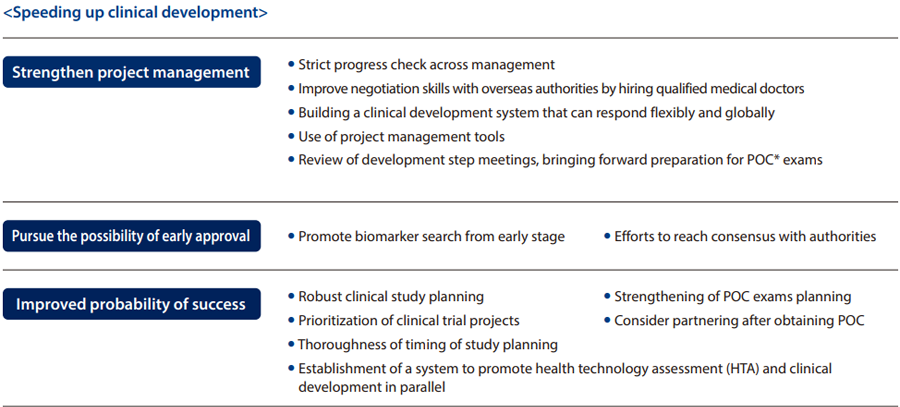

- (2) Speeding up R&D

-

In drug discovery research, we aim to shorten the time from the conception of a theme to its entry into clinical trials, and to establish a system that enables us to launch one in-house product each year.

As for delays in clinical research, we are working to speed up the process by strengthening project management, pursuing the possibility of early approval, and improving probability of success.

-

- (3) Promoting human capital management that allows each employee to grow and diverse human resources to play an active role

-

The volume of operations is forecast to increase as we expand globally. Aiming to become a small but unique team, we will draw out the potential of each individual as much as possible and move forward with acquiring and developing human resources to support our global expansion and reforming our organizational culture.

-

- (4) Business process reengineering and productivity improvement by promoting digitalization

-

Since digital technology is advancing rapidly, we proactively invest in digital systems and human resource development to take advantage of those advances.

We work to speed up and improve the efficiency of operations by tackling issues that arise in R&D and sales promotion activities through a data-driven response.

Having defined “human resources for business process reengineering (BPR)” as human resources who can fundamentally reform operations and create new businesses by discovering issues through the use of digital technology, knowledge, and business skills, we aim to have 10% of employees human resources for BPR by FY2028.

-

- (5) Financial strategy for sustainable growth

-

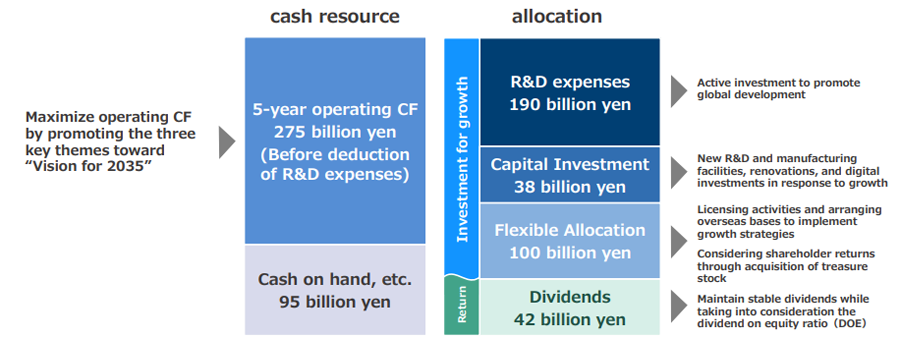

Develop a capital allocation and make strategic investments necessary for sustainable growth while ensuring financial soundness.

Current Medium-Term Management Plan

Nippon Shinyaku 7th Five-Year Medium-Term Management Plan (FY2024-2028)

Past Medium-Term Management Plan

Nippon Shinyaku 6th Five-Year Medium-Term Management Plan (FY2019-2023)

Management Policy and Plan

- Message from the President

- Business Philosophy/Management Policy

- Medium-term Management Plan

- Basic Policy for R&D

- Business risks